The best way to use rebates to attract new business is by using a straight cash discount, right?

After all, cash discounts are easy for customers to understand and straightforward to apply.

However, just because a concept is simple, doesn’t make it right. True – a cash discount or rebate will certainly have instant appeal. But, let’s first take a step back and address the fundamental question that we should be asking before planning any campaign – what are we trying to achieve?

Delivering a long-lasting and loyal customer base

Let’s say the answer is – a quick sale. Then maybe a cash discount will work best. On the other hand, what if our goal is more long-term? What if our aim is to build a lasting and loyal customer base? What if we want to become our customers’ ‘most-loved’ supplier – one that they remember, talk about and return to, by default, time and again? If this is our holy grail, then we should be looking at initiatives that have long-term perceived value and that provide our business with customer loyalty that ‘sticks’.

Rebates

When comparing alternative rebate programmes, we need to address three questions:

- Ease of use – Is the programme easy to understand, and will it be the most attractive ‘bait’ for your potential customers?

- Building long-term brand loyalty – Will the programme serve your goal of building long-term customer loyalty and strengthening your customer base?

- Margins and cash flow – Will the programme be healthy for your business? What about its impact on margins and cash flow?

First, let’s look at each of these questions in relation to cash rebates.

1. Ease of use – A cash rebate programme is certainly simple to understand. Once a certain level of spend is achieved, the customer then receives their ‘cashback’ either immediately following the purchase, or at the end of a given purchasing period. If you want to retain a ‘premium’ feel to your brand, then rebates remove the need to advertise a discount. Customers can see the monetary value of buying your products. Instead of receiving 25% off a £1000 product, they might be attracted by the offer of ‘£250 back’ following their purchase.

Learn more about Incentivesmart’s B2B customer loyalty platform.

2. Building long-term brand loyalty – How effective are cash rebates for reinforcing customer loyalty? Think about the last time you received a cash rebate or discount. Do you remember its value? Even more important – do you recall what you spent the cash on? Or did you consciously spend it at all? Did the money simply sit in your account to be absorbed by everyday expenses? If the long-term goal of your programme is to build brand loyalty, then it needs to be memorable. This is much less likely with cash rebates than strategically designed channel loyalty programmes.

3. Margins and Cash flow – Finally, what will the impact of a cash loyalty programme be on your margins and cash flow? You’ll probably see a short-term uplift in sales. But, what are the chances of retaining those customers for the long-term? Before embarking on your programme, it’s vital that you make accurate margin and cash flow forecasts. Fail to prepare for the outflow of cash plus the hit to your margins, and you could find yourself in trouble – especially if things go wrong. Remember the Hoover fiasco?

Let’s say your mark-up is double, then offering a 20% cash discount or rebate, you’ll lose 40% of your profit, with every sale. You have to decide how much of a cash rebate or discount you’re prepared to offer in exchange for ‘buying’ a questionable degree of loyalty.

A better solution to rebates

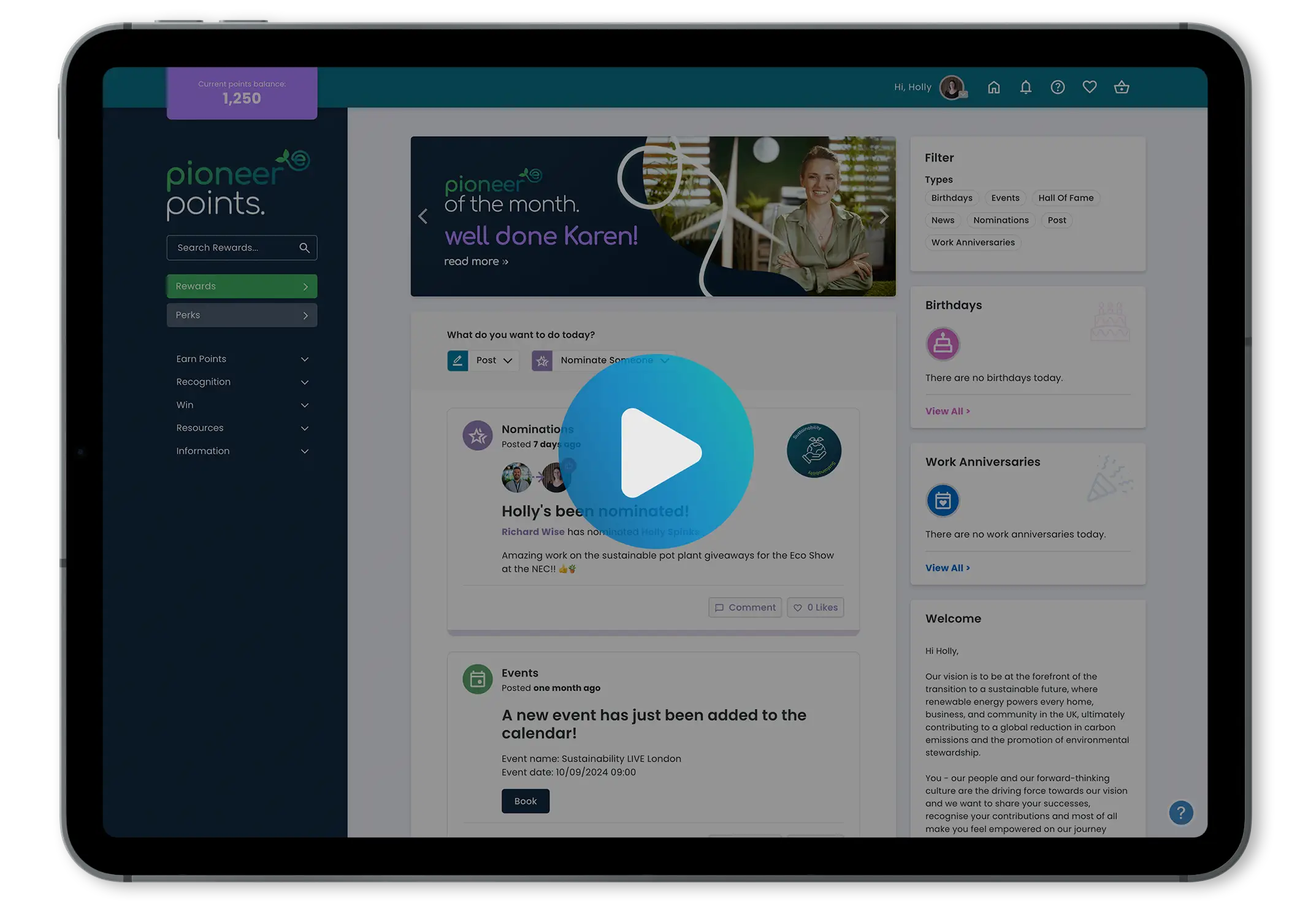

Let’s take a look at the type of rewards offered by Incentivesmart Channel Loyalty programmes and how they address each of these questions.

1. Ease of use – Any non-cash incentive can come across as more complex than a straight discount and can be seen as a disincentive. However, they don’t need to be complicated at all! You might go for a pounds = points programme – where each pound spent by a customer goes towards their own points account (Tesco Clubcard for example) – for customers to redeem whenever they choose. You also have to decide about redemption – how many hurdles your customer has to jump through before receiving their benefit.

2. Building long-term brand loyalty – The benefit of non-cash rebates is that they are far more memorable. Your customers are far more likely to value their redemption if it’s something they remember – if it gives them the opportunity to acquire something they enjoy or have an experience that’s in some way extraordinary. Then, they become your brand ambassadors.

However, not everyone will take advantage of your rebates. You might welcome the savings you make when customers don’t claim their rebate. But that’s something of a short-term view. It’s far better, in the long-run, that customers do claim because then they’ll remember your brand and provide excellent word-of-mouth about your product to anyone who will listen.

3. Margins and cash flow – The beauty of non-cash redemption is that the value of the redemption can seem much higher than the actual cost to your business. A redemption of £300 of non-cash goods or services in return for a £1,000 purchase, might feel like a 30% discount to the customer. Yet it might only cost your business, for example, £100. Better yet, if you offer points and customers don’t redeem them, you don’t have to pay for any reward.

Incentivesmart’s channel loyalty programme

Our customer loyalty programme gives you all the benefits you need! Loyal customers are a vital component of sustainable business growth. They have the advantages of being –

- less price-sensitive

- immune to competitive approaches

- a key element of your marketing armoury, effectively promoting and defending your company – for free.

For a customer programme to be effective, it needs to focus on product knowledge, brand engagement and changing everyday behaviours. The goal of our programmes is to turn your customers into brand advocates and evangelists, who truly believe in your brand.

Our programme uses points banking technology to manage enterprise-level reward programmes. Our solutions help develop stronger and more rewarding relationships, so you can increase loyalty, improve communication, create brand advocates and achieve higher sales.

Find out more about our customer loyalty programme by scheduling a demo today.

![How to keep customers coming back for more{{ include_custom_fonts({"Poppins":["Semi Bold"]}) }}](https://no-cache.hubspot.com/cta/default/5921162/interactive-188375258646.png)