Since the Bribery Act 2010 came into law in July 2011, there has been a large amount of fear and uncertainty that sales incentives, promotions and reward programmes could fall foul of it, and that companies operating such activities may be prosecuted for it. It’s a situation that is not helped by a lack of clear guidance from lawyers, and the incentive industry itself. Nor do sensationalist headlines in the tabloids help, making the spurious claim, such as tips for the postman, could land them in prison.

Under Section 2 of the Act it is an offence if a person requests, agrees to receive, or accepts an advantage, financial or otherwise, with the intention that they or someone else perform a relevant function or activity improperly. In other words, in order to fall foul of the act you would be acting inappropriately for personal gain so there is no fear of having your Nectar or Tesco Clubcard seized under this act, they are legitimate loyalty strategies which are commercially justifiable.

The Serious Fraud Office is an independent Government department that investigates and prosecutes serious or complex fraud and corruption and is the lead agency for investigating and prosecuting offences under the Bribery Act. Richard Alderman, Serious Fraud Office Director, has previously stated that giving incentives can be justified but that businesses should declare what they issue. “Incentive payments are normally designed for commercial reasons and are commercially justifiable,” Alderman said in a speech in May.

“What we have been talking about with corporates is the need for transparency and, in particular, the need to know where the money goes and the fact that it is justifiable. We also talk about the need for a senior person at the corporate’s head office to have visibility of what is happening and to be satisfied that what is happening is justifiable,” he said.

The first successful prosecution under the Bribery Act was to a court clerk who took a £500 bribe to ‘get rid of a speeding charge’; all subsequent prosecutions have all been as a result of clear-cut misdemeanours by the offenders, all for cash payments. At the time of writing there have been new cases against a corporation under the new act.

Barry Vitou, an anti-corruption expert at Pinsent Mason Solicitors says that The Bribery Act makes it an offence for businesses to fail to prevent bribery by people working for or on behalf of a business. Companies can escape liability if they show that they have ‘adequate procedures’ designed to prevent bribery in place. Vitou said that it was “key” that business make “fully transparent” any incentive arrangements.

The key word emerging from the SFO and legal experts is ‘transparency’; as long as all parties are clear on what incentives are being made, to whom and for what, then incentive programmes are a commercially justifiable part of a company’s sales promotion and customer loyalty strategy. The need for transparency makes it even more important that prizes are distributed as part of a structured incentive programme that can be tracked and audited.

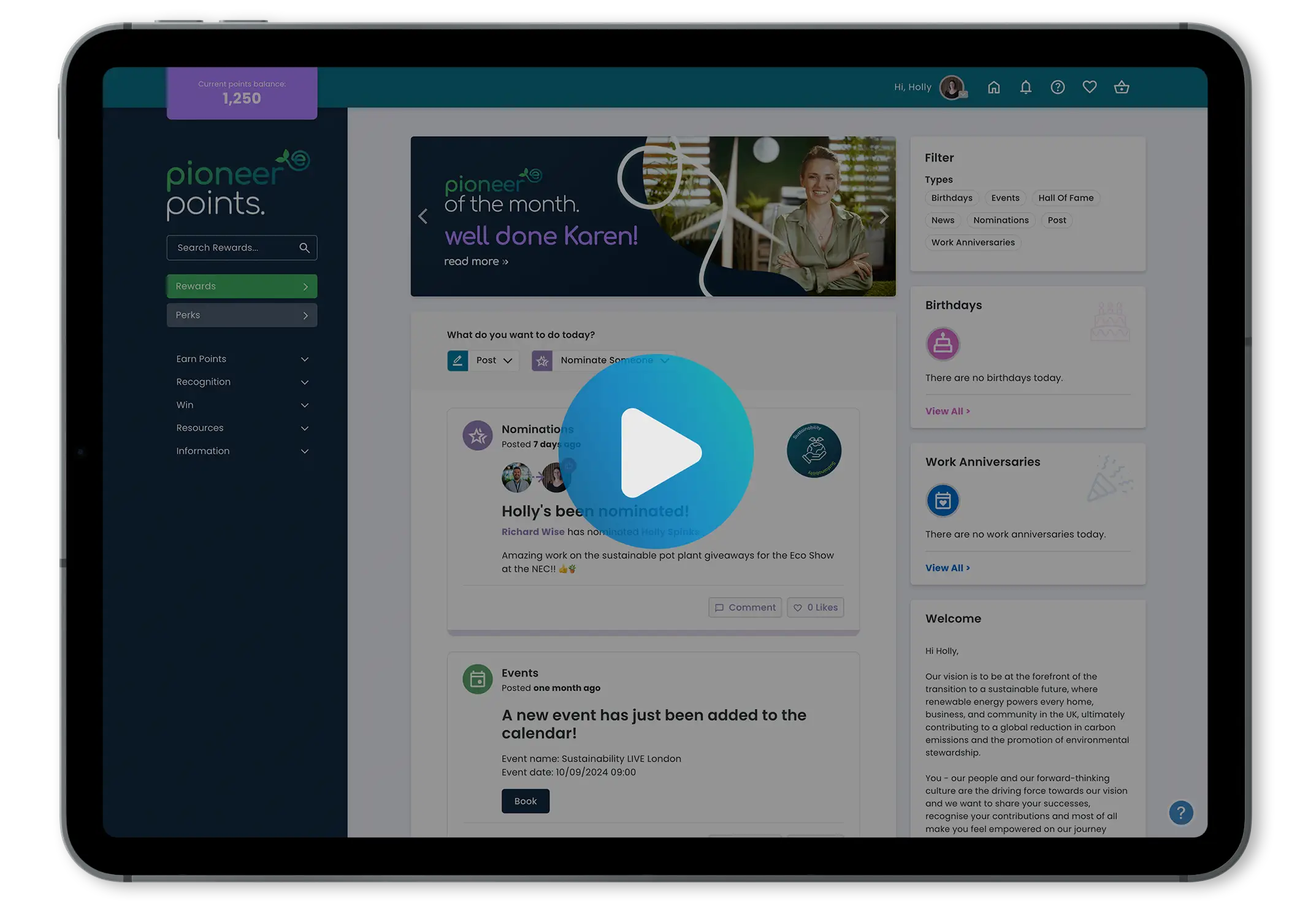

Incentivesmart programmes offer a suite of reporting and auditing tools to ensure that your programme is fully documented and we make it clear to our customers that they should take adequate measures to ensure that the employers of programme participants are aware of the incentives.

Useful links

For clarification or confirmation of any of the topics covered in this article, please refer to the following link for guidance: https://www.gov.uk/government/publications/bribery-act-2010-guidance

Please note that Incentivesmart Ltd do not offer professional legal or tax advice. All information is not warranted as to completeness or accuracy, is made without prejudice and is subject to change without notice. Any comments or statements made herein do not necessarily reflect those of incentivesmart Ltd, subsidiaries or affiliates.

![How to keep customers coming back for more{{ include_custom_fonts({"Poppins":["Semi Bold"]}) }}](https://no-cache.hubspot.com/cta/default/5921162/interactive-188375258646.png)