Data, data, everywhere – and yet, a lot of the time, it never quite hits the spot. These days, thanks to automation and AI, we’re able to gather more data than ever before, easier than ever before. A single customer’s journey from social media to email to your site to your checkout – or, in B2B, that more complicated journey through the funnel – generates 360° of insights.

And, of course, the more you gather, the more you know. Data is great for the bigger pictures of marketing, sales, product development and competitive analysis, but also for the smaller picture – for personalisation and building emotional engagement with individual customers.

A lot of companies are sitting on a pile of data that could be incredibly valuable, if they just gave it a chance.

But, even still, not all data is created equal, and that’s why so much of the data we bank seems to fizzle rather than pop. It all starts at the source, and the fact that we need to extract our data from the right places…

The best places to collect customer data

Customers perform and complete a lot of actions that generate data. Some of the most obvious are surveys and chatbots – media that necessitate some sort of exchange of information, and tend to get a healthy mix of quantitative and qualitative insights. The trouble is, on average, a typical survey can see a response rate as low as 5% (or as high as 30%). There are ways to take your surveys from ‘typical’ to terrific — such as offering incentives through your loyalty programme, but more on that later – but, in general, they can’t be relied upon as your biggest source of customer data.

And why should they be? Customers don’t always give an accurate reflection of their experiences, feelings, and relationship with your brand when prompted – not through any malice, but because they have limited time and interest to invest in the many surveys brands send out on any given month.

Customer behaviours are far more candid. Think of your marketing emails – KPIs like opens, click—throughs, and conversions – as well as social media interactions (likes, clicks, tags/mentions, sentiment analysis), transactions and purchase histories, CRM platforms and, of course, how they use and navigate your website.

But there’s a vital piece missing from the puzzle – your customer incentive platform. With the right approach, your loyalty scheme can not only compel customers to be more loyal to you (and, ultimately, spend more with you and less with your competitors), but also to leave a breadcrumb of data perfect for offering a more personalized and higher quality experience.

Is Customer Loyalty Analytics the Same as Retention Analytics?

No, there’s a key difference. Retention analytics – also quite dramatically referred to as survival analysis – are all about understanding churn. They give you the big picture in terms of why customers stay, why they leave, and, ideally, how you can lower churn and boost retention. Retention analytics are relatively broad – hence the ‘bigger picture’ they create.

Retention rates tend to be relatively high, although they do vary by industry. The average retention rate for the media industry, for instance, is 84%, while the average retention rate for the hospitality industry is just over 50%.

By contrast, customer loyalty analytics are those generated through your customer loyalty scheme. They focus on the big picture to an extent, but also on the small picture – on the individual customers that use your scheme and, together, facilitate long-term growth.

Looking at retention and loyalty analytics side-by-side can be invaluable when it comes to identifying potential leaks in your customer experience, but it’s important not to confuse the two.

Think of the fundamental difference between retention and loyalty. A retained customer is only ‘retained’ until they lapse. A loyal customer, however, is one who is, by definition, in it for the long-term. They feed into the company’s projections – its ability to grow, rather than stagnating or, worse, backsliding.

We often talk about evangelistic loyalty – customers who feel so committed and engaged with your brand that they will happily promote you (without any prompting) to their friends, co-workers, peers, etc. These are the perfect customers or channel partners to have, given the indomitable power of user recommendations and reviews and positive UGC.

The great thing about tracking customer loyalty analytics is the fact that they tend to create patterns, and patterns are perfect for developing our understanding and highlighting what we need to be doing more (or less) of.

Data, Patterns, Loyalty

The average customer isn’t an irrational being. In other words, there’s a rhyme and reason to their behaviours – when they purchase, what motivates them to make that purchase – whether it’s something transitory, like a deal or promotion, or, ideally, genuine loyalty –how willing they are to recommend your products or services to someone else and, ultimately, how likely they are to remain a long-term customer of your brand.

A lot of this information can be extracted from their behaviours (or lack thereof) and interactions with your platform. Others, you’ll need to be more proactive about capturing.

A supermarket is always a handy analogy for this. When a customer walks into the shop – whether it’s for a couple of basic items or a mammoth weekly shop – and scans their loyalty card at the checkout, then those purchases are logged in a much larger pattern of spending. At the end of the month, they tend to invest in some sort of decadent dessert, whereas, at the beginning, it’s all about buying up veg and fruit in bulk for meal prep. This sort of understanding is ideal for creating more personalized experiences – and that’s exactly what serves to create and sustain better, more meaningful relationships with customers.

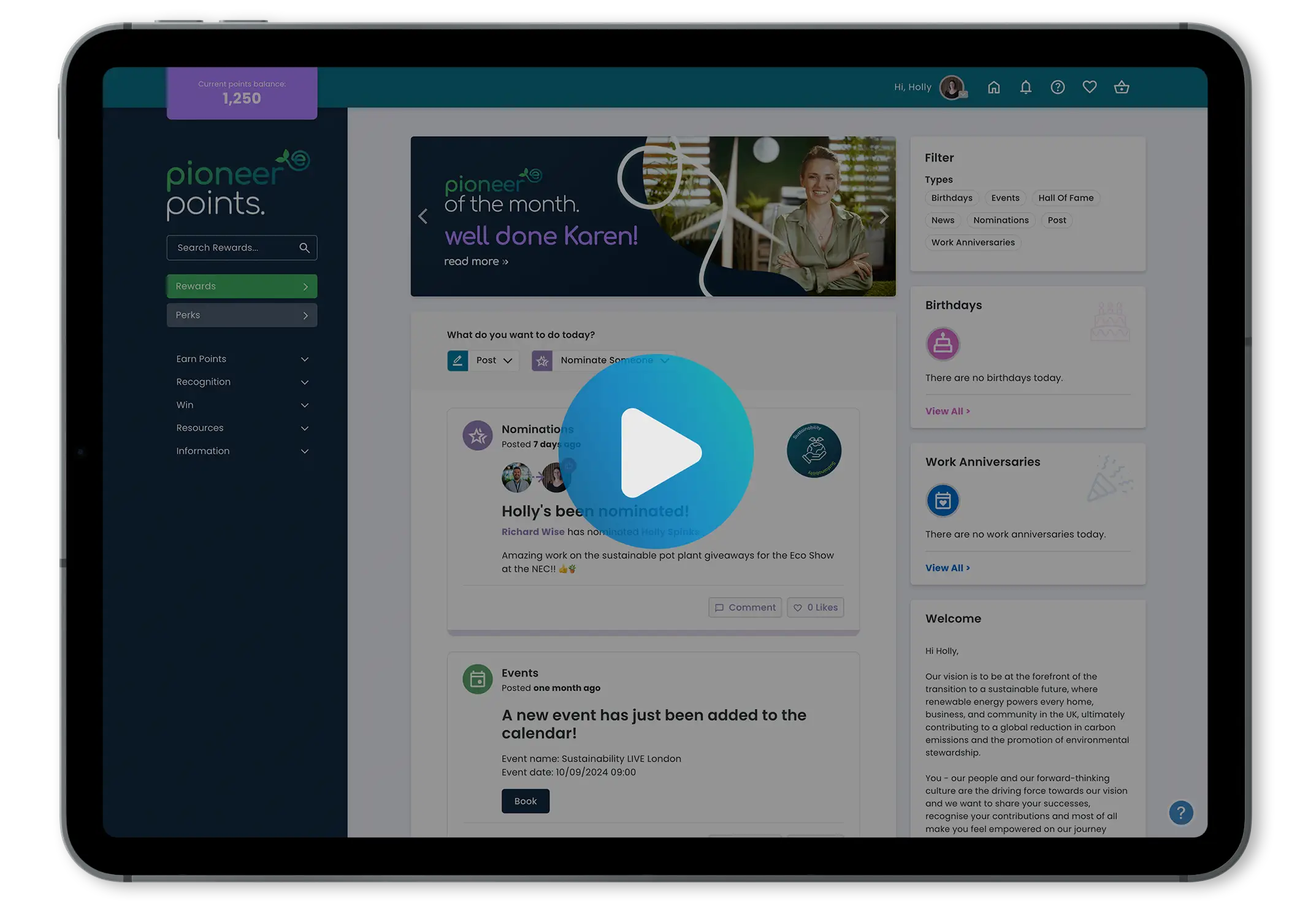

Ultimately, the more you can encourage your customers to interact with the platform, the better your insights will be. This is what we’re all about at Incentivesmart – creating a platform that naturally encourages more interaction from customers is at the heart of everything we do. Giving points for purchases – points that, once accumulated, grant the customers access to some great rewards – is only the bare bones of loyalty incentives. True, they’re enough to encourage retention, but, for real, bottom-line boosting loyalty, you need more than that.

Getting the most valuable loyalty data possible

Just recently, we published another blog post about the value of gamification. When we can make things fun and compelling, we can get a lot more out of the participants, whether you’re implementing a tiered leaderboard system in the office or offering points-based prizes to customers who participate in your surveys and events.

In other words, you can’t shortcut your way to rich, valuable data and insights. You need a platform that is purpose-built for engagement, and that’s what has given our Incentivesmarties such a passion for making loyalty fun, rewarding, and inspiring.

From surveys and events to pop quizzes (great channel incentives for boosting partners’ understanding of your brand and products outside of more traditional training days), gamified interactions with your brand’s loyalty platform are a great complement to points-based rewards for transactions.

Using Loyalty Data

The thing about retention analytics is that it tells a very definitive, clear story. It tells you how many customers you’re keeping vs how many you’re losing in any given month, quarter, or year. The point of extracting and analysing this data goes without any detailed explanation.

But what about the piles of data your loyalty platform is generating? It’s a great thing to have but, like a pretty ornament with no real purpose, it can leave you wondering, ‘Great, but why?’

There are three key ways to utilise customer loyalty data: personalisation (creating tailored B2B communications that stand a much higher chance of engaging customers), improvement and continued innovation on your products and services, and, of course, further improvements you can make to your rewards.

These improvements are key. By some estimates, more than 90% of companies have some sort of loyalty scheme in operation. Even if the actual figure isn’t that high, it’s safe to say that the majority of businesses are running some kind of loyalty programme for customers. But customers aren’t equally invested in every single loyalty scheme they sign up to; only the schemes that offer the clearest structure, the best rewards, and the most compelling platforms will see the full benefit.

Personalisation is also the key to fostering better, longer lasting, and more meaningful relationships. A good customer experience is one that feels smooth, frictionless, and productive – a great customer experience, by contrast, is one that feels tailored, rewarding, and indicative of a brand that’s as invested (if not more so) in its existing customers as they are acquiring new business.

At Incentivesmart, creating loyalty platforms that deliver the highest possible ROI – not just in terms of return business and higher customer value, but also in terms of insights and invaluable analytics – is what we do. Get in touch with our team today to find out more about implementing a strong, rewarding B2B incentives programme for your business.

![How to keep customers coming back for more{{ include_custom_fonts({"Poppins":["Semi Bold"]}) }}](https://no-cache.hubspot.com/cta/default/5921162/interactive-188375258646.png)